We offer four strategies that span a

Every Geneva portfolio is backed by our single, focused investment approach.

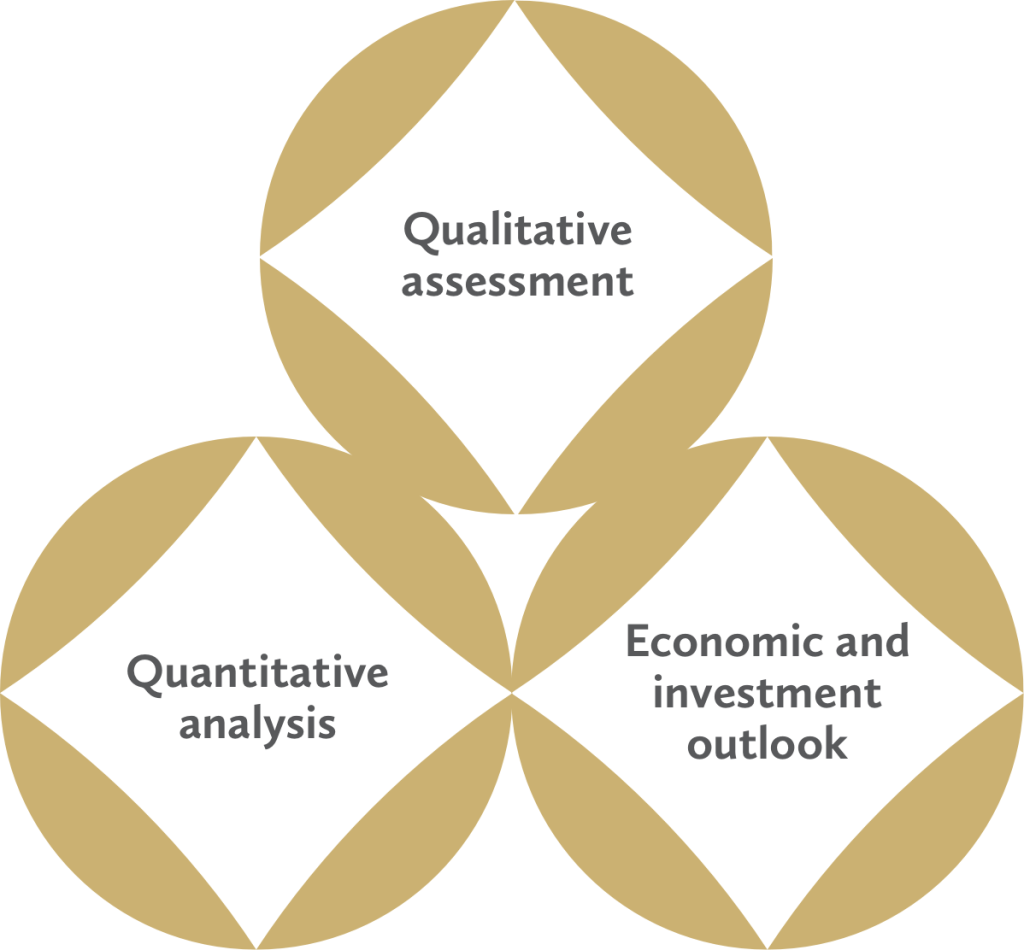

Qualitative assessment

of market leadership and long-term competitive advantage

Quantitative analysis

of financials and projected growth

Economic and investment outlook

to determine relevant macro trends

Market outlook

Download our latest analysis of market trends.

Our strategies

Generally within the range of the Russell 2000® Growth Index, these companies tend to be smaller dynamic growers with strong profitability, which allows them to fuel their growth prospects.

Our SMID strategy harnesses the best ideas from our small-cap and mid-cap portfolios to create a high-conviction, best ideas portfolio.

Our Mid Cap strategy focuses the majority of assets on companies in the Russell MidCap® Index. Mid-cap companies are unique in that they are more stable than small-cap but can provide more exciting growth opportunities than large-cap.

Offering the broadest range of stocks, our All Cap strategy combines the higher growth potential of our small- and mid-cap strategies with the added stability of larger, more mature companies.